On Sunday, May 2 2021, the Universitas Airlangga Department held a Sharia asset and liability management workshop with the theme "Sharia Bank Competitive Map and 2021 ALMA (Asset and Liability Management) Strategy". The workshop started at 08.30 by Mrs. Lina, lecturer at the Faculty of Economics and Business Universitas Airlangga as Moderator for the event. The speech was delivered by Mrs. Sri Herianingrum, but was represented by Mr. Sulistya Rusgianto from the Islamic Economics department, Universitas Airlangga.

In his speech, Mr. Sulistya said that ALMA is not limited by the times, and as times and technology change, ALMA will also change little by little. In the Sharia concept, the mismatch between assets and liabilities should be easier.

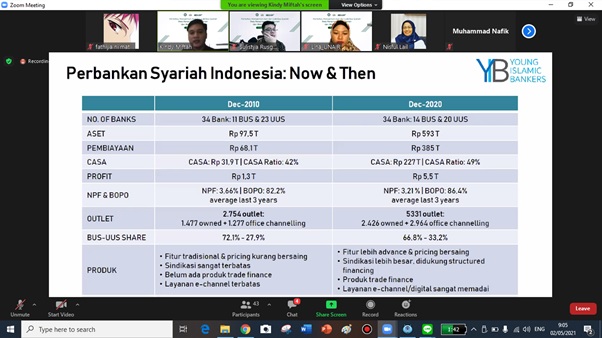

Then continued with material presented by Mr. Kindy Miftah, Sr. Manager of Syariah Business Banking Analytics. He said that ALMA is the heart of the banking world. Looking at the number of Sharia banks in Indonesia which remains at 24 due to the conversion and spin-off of a number of Sharia banks, it is clear that Sharia banking is experiencing growth. If we look at the total assets from 2010 with a nominal value of 97.5 trillion and a profit of 1.3 trillion compared to 2020 which reached assets of 593 trillion and a profit of 5.5 trillion, the growth that has occurred looks very positive. Mr. Kindy also said that in the last 10 years, in terms of products, Sharia banking features have become more advanced and pricing compete with large conventional banks. A statement states that Sharia banking can still continue to grow in the future, so the homework for all of us is how Sharia banking reaches the national realm in terms of portfolio to become even better.

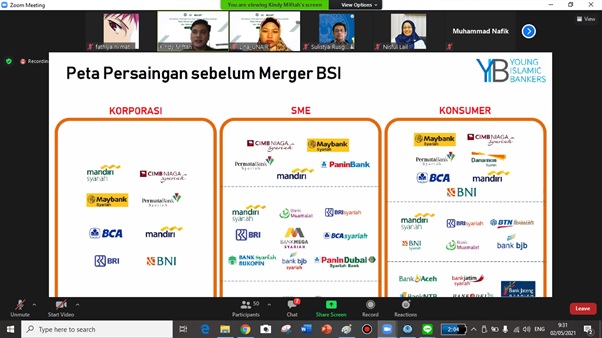

In his material, Mr. Kindy said that BSI as the largest Sharia bank currently controls 40% of market share , where its competition is no longer with other Sharia banks, but with large conventional banks. Sharia Bank itself in terms of CASA ( Current Account Saving Account ) and CoF ( Cost of Funds ) growth is quite high. BSI has potential in the top quality segment.

The first ALMA 2021 strategy as stated by Mr. Kindy is FDR Rebalancing. Sharia banking FDR has touched its lowest level in history so it must continue to maintain a tight balance between financing growth and expensive fund portfolios.

Then the second is to keep the Cost of Funds stable and follow the trend. In the midst of recovery , maintaining stable CoF is more important than seeking optimal NIM. Sharia banks must choose which funds to retain while also following interest rate trends. Then the third is long-term cheap fund focus. Focus on promotional costs rather than funding costs (profit sharing/bonuses). Aggressive digital products and customer base

After delivering the material, the closing statement was a message from Mr. Kindy to the participants. The content of his message is that we must make efforts to grow sharia banking, especially market sharing . Everyone is moving to support Sharia finance so that in the future it will be even better. Then second statement The content of his message is let's all prepare to support the growth of Sharia banking. Universitas Airlangga students were not prepared to be able to work straight away, but rather how they could adapt quickly.

The workshop event closed with a group photo session and was officially closed by Mrs. Lina as the event moderator. Alhamdulillah, the event ran smoothly without any problems and he was grateful for the active participation of the participants at the closing . (Fath/DES)